We’ve all been there—checking our bank account at the end of the month and wondering where all the money went. Managing finances can feel overwhelming, especially with unexpected expenses, fluctuating incomes, and the sheer number of transactions to track. Whether you’re trying to save for a big goal, keep your household budget in check, or run a business without financial hiccups, staying on top of your money is essential.

The good news? You don’t need to be a financial expert to take control of your budget. Excel Templates offer an easy, effective way to organize income and expenses, spot spending patterns, and plan for the future. With pre-built formulas and customizable features, these templates take the guesswork out of budgeting, allowing you to focus on what truly matters—achieving your financial goals.

In this guide, we’ll walk you through how to use Excel Templates for budgeting, highlight their benefits, and introduce you to some of the best templates available. Whether you’re new to budgeting or a seasoned pro looking for more efficiency, this article will help you make the most of Excel’s powerful tools.

Why Use Excel Templates for Budgeting?

1. Ease of Use

Excel Templates are pre-designed spreadsheets that eliminate the need to create complex formulas from scratch. They come with built-in functionalities, such as automatic calculations and visual representations, making budget management effortless.

2. Customization Options

Unlike other budgeting software, Excel Templates allow full customization. Users can tailor categories, add or remove columns, and modify formulas to suit their specific financial goals.

3. Automation and Accuracy

With predefined formulas and functions, Excel Templates reduce the chances of human errors in calculations. This automation helps users track spending habits and financial trends with accuracy.

4. Cost-Effective Solution

Since Microsoft Excel is widely available, using its free or premium templates is an economical alternative to paid budgeting apps.

How to Use Excel Templates for Budgeting

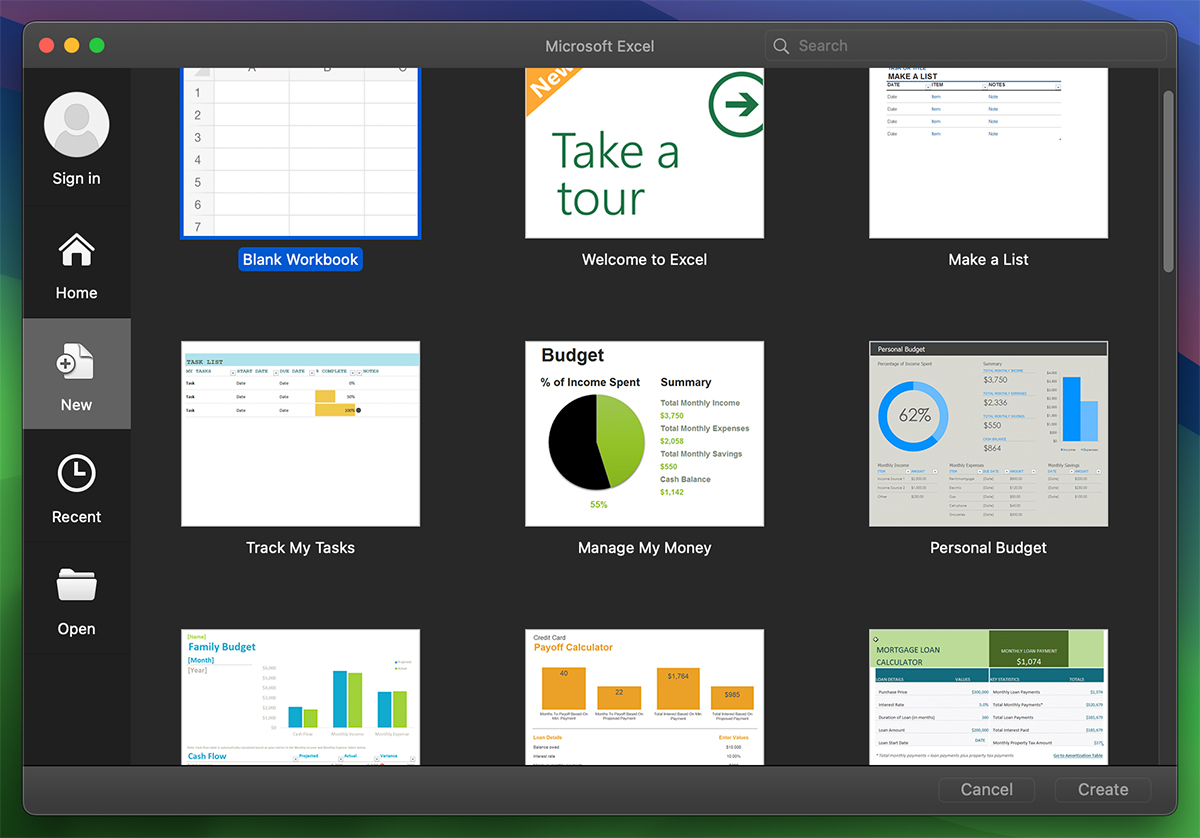

Step 1: Select the Right Excel Template

There are various types of Excel Templates available for personal and business budgeting. Some popular options include:

- Personal Budget Template – Tracks income, expenses, and savings goals.

- Monthly Budget Template – Helps manage monthly income and expenses.

- Small Business Budget Template – Organizes business revenue, expenditures, and financial projections.

- Event Budget Template – Plans and tracks expenses for specific events or projects.

- Household Budget Template – Manages family finances, bills, and groceries.

Choose a template that best suits your needs from Microsoft’s official template library or other reputable sources.

Step 2: Input Your Financial Data

Once you’ve selected the appropriate template, enter your income sources, fixed expenses (rent, utilities, loans), and variable expenses (groceries, entertainment, dining out). Most templates will automatically calculate totals and display a summary of financial health.

Step 3: Use Formulas for Customization

Excel’s built-in functions such as SUM, IF, and conditional formatting can be leveraged to customize templates further. For instance, you can:

- Set up conditional formatting to highlight overspending.

- Use IF functions to flag unexpected expenses.

- Create charts to visualize financial trends.

Step 4: Track and Update Regularly

Consistency is key to successful budget management. Update your Excel Template frequently to ensure accurate tracking of expenses and adjust allocations as needed.

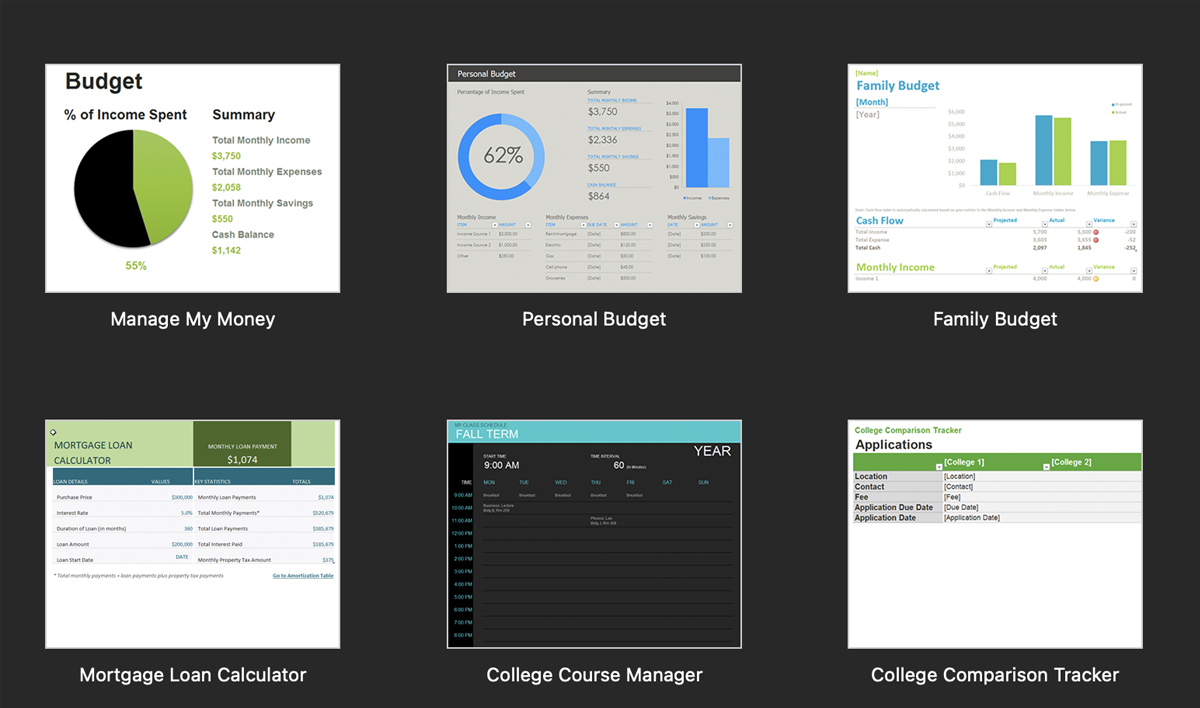

Best Excel Templates for Budgeting

1. Microsoft’s Personal Budget Template

This template provides an easy-to-use layout that categorizes income and expenses while generating an overview of monthly savings.

2. Vertex42 Monthly Budget Worksheet

A highly customizable template that provides detailed breakdowns of expenses and includes graphs for better financial visualization.

3. Small Business Budget Planner by Smartsheet

Designed for business owners, this template helps track revenue, fixed and variable costs, and financial forecasts.

4. Simple Event Budget Planner

Perfect for managing event-related expenses such as weddings, parties, and corporate functions.

5. 50/30/20 Budget Template

Based on the popular budgeting rule, this template helps allocate income into needs (50%), wants (30%), and savings (20%).

Read:50/30/20 Monthly Budget Calculator

Tips for Effective Budget Management with Excel Templates

- Regularly review and adjust budgets to reflect financial changes.

- Set financial goals to stay motivated and disciplined.

- Use color coding and graphs for better visualization.

- Save copies of budgets monthly to track financial progress over time.

- Utilize Excel’s data validation to avoid input errors.

Conclusion

Tracking and managing budgets with Excel Templates is a smart and efficient way to gain control over your finances. Whether you are managing personal expenses, household finances, or business budgets, Excel provides versatile and user-friendly templates to suit every need. By selecting the right template, inputting accurate financial data, and reviewing it regularly, you can ensure financial stability and growth.

Read Also: Microsoft Excel 2021 Free Course